[/imageframe][/fullwidth][fullwidth background_color=”white” background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” overlay_opacity=”0.5″ video_mute=”yes” video_loop=”yes” fade=”no” border_size=”0px” border_color=”” border_style=”solid” padding_top=”20″ padding_bottom=”20″ padding_left=”” padding_right=”” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=””][separator style_type=”none” top_margin=”30″ bottom_margin=”30″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” class=”” id=””][fusion_text]

[/imageframe][/fullwidth][fullwidth background_color=”white” background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” overlay_opacity=”0.5″ video_mute=”yes” video_loop=”yes” fade=”no” border_size=”0px” border_color=”” border_style=”solid” padding_top=”20″ padding_bottom=”20″ padding_left=”” padding_right=”” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=””][separator style_type=”none” top_margin=”30″ bottom_margin=”30″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” class=”” id=””][fusion_text]Apply cash aids from the Employment Retention Programme (ERP), (Wage Subsidy Programme) WSP & Bantuan Prihatin Nasional (BPN)

[/fusion_text][fusion_text]Human Resources Ministry said that all salaries and allowances must be paid except for transport allowances that will not be used during the period, any cuts in salaries and benefits should first be discussed and agreed upon by employees, said the Human Resources Ministry in a statement on frequently asked questions issued by the National Security Council.

The FAQ statement also said all employers of essential and non-essential services which “are allowed” to operate during the MCO must ensure that all health precautions must be taken for employees such as body temperature monitoring, providing of sanitisers and social distancing. (MOH related article)

Employee taking unpaid leave starting 1st March are eligible to apply for cash aids from Employment Retention Programme (ERP) of up to RM600 a month due to the COVID-19 pandemic.

[/fusion_text][fusion_text]✍️SITUATION 1

EMPLOYMENT RETENTION PROGRAMME (FOR A PERIOD OF 1 TO 6 MONTHS, EMPLOYERS CAN CLAIM RM600 PER WORKER TAKING UNPAID LEAVE)

Workers who are taking “unpaid leave” for minimum of 30 days to 6 months.

We have outlined below the information and the website links.

Employment Retention Programme (ERP) (For a period of one (1) to six (6) months, employers can claim RM600 per worker taking unpaid leave)

ELIGIBILITY

Eligibility is subject to employees registered and contributing to EIS with wages RM4,000 and below.

Employers apply on behalf of employees and must transfer RM600 directly to the employee’s account.

APPLY

Application can be made by employers through emailing the ERPC-19 form to erpc19@perkeso.gov.my starting 20th March 2020.

Download ERPC-19 Form here

PAYMENT

Payment is credited to the employer’s account within 7 days submission of application.

[/fusion_text][fusion_text]✍️SITUATION 2

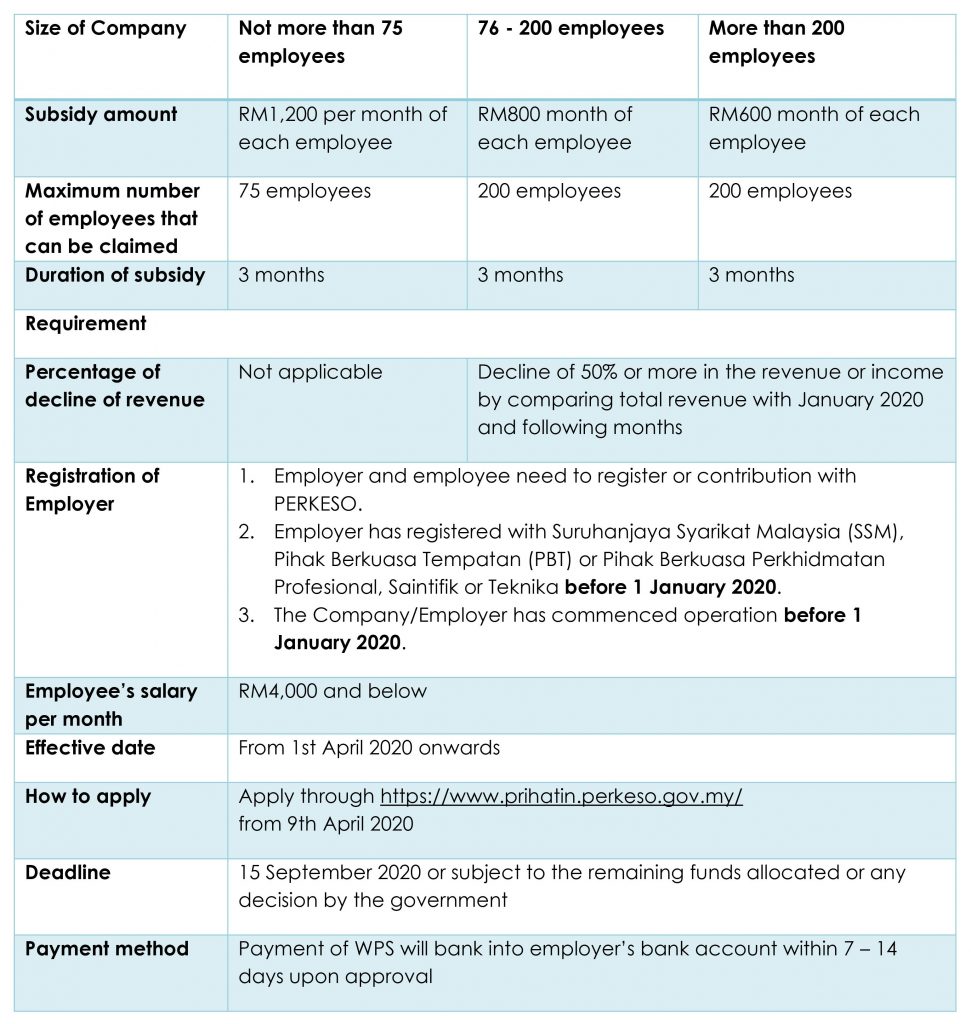

WAGE SUBSIDY PROGRAMME (FOR A PERIOD OF THREE MONTHS, EMPLOYERS CAN CLAIM RM600 – RM1,200 PER WORKER)

(Click to download latest guideline from SOCSO & MOH)

We have outlined below the information and the website links.

– More than 200 workers, subsidy RM600 per worker (Maximum workers eligible is 200)

– 76 to 200 workers, subsidy RM800 per worker.

– Up to 75 workers, subsidy RM1,200 per worker.

1. When WSP start effective and when is the last application?

– WSP start effective from 1 April 2020.

– WSP cover for 3 months effective from 1st April 2020 or from the month applied.

– Last day of application of WSP is 15 September 2020.

2. Important features of WSP:

3. Who is NOT QUALIFIED for WSP

– Employer or company register or commence operation on or from 1 January 2020

– Employer or employee not yet register with PERKESO

– Employee who receive Employment Retention Program for the same month.

– Employee’s salary more than RM4,000

– Employee has been lay off

– Government servant

– Freelancer

– Foreign worker and expatriate

4. Document required for WSP?

– Name list of employee

– Bank account number (attach 1st page of bank statement)

– Business Registration Number (BRN). BRN is Company Number. Example: 1234560-X

– SSM Registration Cert such as Form 9 or Section 13 (CA 2016)

– Declaration PSU 50 Form; and

– *Supporting documents such as Statement of Profit and Loss and Revenue Report. These documents need to be verified by management.

*Applicable to the companies size more than 75 employees and above.

5. Does the employer need to make a claim monthly for the wage subsidy payment?

For the subsequent month, the wage subsidy will be automatically paid to the respective employer/company.

6. Can the employer operating before 1st January 2020 but not registered with SIP apply for WSP?

– Yes but must register with SSM or PBT before 1st January 2020

– Minimum 1 employee

– Registered with PERKESO

7. Can employer which have applied for ERP, apply now for WSP?

The employer must fulfill the terms and conditions for the Wage Subsidy as per Table 1.

8. Can the employer re-apply for the latest Wage Subsidy (announced on 6 April 2020) if the employer already applied for the Wage Subsidy which announced on 27 March 2020?

Yes. For the employer who have applied the Wage Subsidy which announced on 27 March 2020 with more than 100 employees. The employer can make new application with NOT MORE THAN 200 employees and must fulfill the terms and conditions as per Table 1.

9. Can the employer apply Wage Subsidy and ERP for the same employee at the same time?

No. The employer not allowed to apply the Wage Subsidy and ERP for the same employee at the same time. But, the employer allow to apply the Wage Subsidy and ERP for difference employee at the same time with terms and conditions as per Table 1.

10. How to determine the 50% sales decrease to qualify for the Wage Subsidy?

Employer need to compare the total sales or revenue in January 2020 and the total sales or revenue in February 2020 or March 2020 was reduce to 50% and below. Then, the employer is qualified for the Wage Subsidy.

11. My company has various Departments/ Units/ Teams. Can the employer choose a part of the employees from these various units?

Yes. Employer can choose any employees as long as they fulfill terms and conditions as per Table 1.

12. If employer submit the application for Wage Subsidy in Jun 2020, will the wage subsidy be paid starting from April?

No. There will be no back payments.

13. One of the criteria for employer is that they must maintain the staff for 6 months. If the employee resign by themselves and the employer is receiving the Wage Subsidy, does the employer need to apply again to reflect the changes?

If a staff resigns willingly within the 3 months of the subsidy period, the employer just need to update the employee information in the system. If the employer failure to do so, it will subject to subject to legal action under the Law.

14. How does the employer know the Wage Subsidy application has been approved?

Employer will be informed thru email. The listing of employers that has been approved will be listed in PERKESO website https://eiscentre.perkeso.gov.my/ including the number of the staff approved.

15. What is the definition of Wages or Salary of RM4,000 and below under the WSP?

The definition follows the salary definition under the Akta Keselamatan Social Pekerja 1969 [Akta 4]. It include overtime, commission, paid leave and etc.

16. If the same employee work for company A and B and both contribute to EIS, does both company qualify to apply for WSP?

Yes, company A and B can apply Wage Subsidy for the same employee as long as fulfill the terms and conditions as per Table 1.

17. My company not yet registered with Employment Insurance System (EIS)? Can I register with SIP now and apply for WSP?

Yes, the employer must register or make any contribution with PERKESO before submission of the application for Wage Subsidy. The Wage Subsidy is only eligible to Malaysian citizens

18. My company has Malaysian citizen and non-citizen employees but haven’t registered with PERKESO. Can I register with PERKESO and apply for the Wage Subsidy Program on behalf of employees of Malaysian citizens only?

Employer must register or contribute with PERKESO before applying for the Wage Subsidy Program. This application is only eligible for Malaysian citizen. Employer must also declare the total number of employee Malaysian citizen and non-citizen**

**Note: The definition of Companies Size is based on the number of employee Malaysian citizen AND non-citizen.

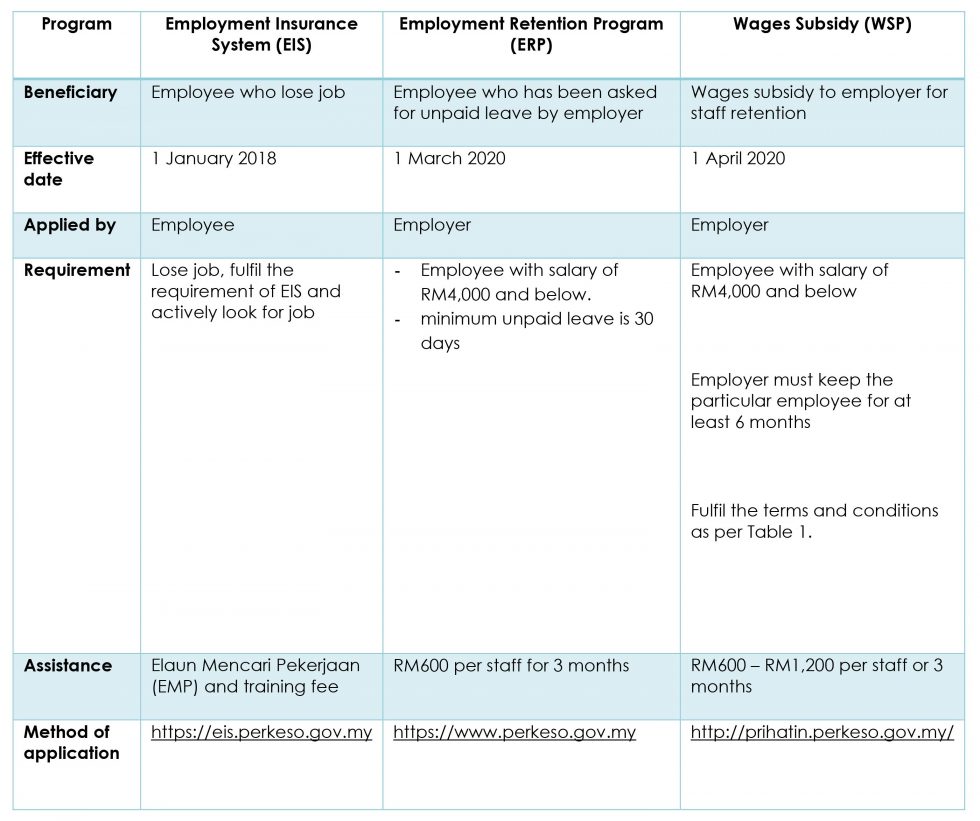

19. What is the difference between SIP, ERP and WSP:

ELIGIBILITY

Employer who have registered with SSM or the authorities local before January 1, 2020 and register with SOCSO

Employer will be required to retain their employees for at least 6 months upon receiving a wage subsidy and 3 months later.

Employer with declining revenue 50% since 1st JANUARY 2020. It is month to month comparison Jan to March 2020 (applicable to 76 workers and above)

Eligibility is subject to employees registered and contributing to EIS with wages RM4,000 and below

Employers shall not be allowed to:

i) Terminate employees

ii) Force employees to take no-pay leave for period 3 months after the implementation of this programme.

iii) Cut salaries of existing employees

APPLY

Application through Prihatin Perkeso can be made by starting 9th April 2020 and deadline on 15th September 2020.

PAYMENT

Payment shall be credited to the employer’s account within 7 days submission of application.

[/fusion_text][fusion_text]✍️SITUATION 3

Comparison between Employment Retention Program (ERP) and Wage Subsidy Programme (WSP) (Latest updates as per 6 April 2020)

3.1 Household income of RM4,000 and below

Eligible to receive RM1,600

Paid on End of April 2020: RM1,000

Paid on End of May 2020: RM600

3.2 Household income of RM4,001 to RM8000

Eligible to receive RM1,000

Paid on End of April 2020: RM500

Paid on End of May 2020: RM500

3.3 Single adults with income of RM2,001 to RM4,000

Eligible to receive RM500

Paid on End of April 2020: RM250

Paid on End of May 2020: RM250

3.4 Single adults with income of RM2000 and below

Eligible to receive RM800

Paid on End of April 2020: RM500

Paid on End of May 2020: RM300

APPLY

– For B40, M40 households and single adults, NO NEED to apply if already registered and approved under Bantuan Sara Hidup (BSH) and LHDNM.

– For eligible Malaysians that have not registered with BSH or LHDN, Start apply on 1st April 2020 at:

1. Lembaga Hasil Dalam Negeri Malaysia, www.hasil.gov.my

2. Bantuan Sara Hidup (BSH), www.bsh.hasil.gov.my

PAYMENT

Payment shall be credited to the bank Account registered under BSH and LHDM.

[/fusion_text][fusion_text]FURTHER INFORMATION

Contact the Ministry of Finance and the Inland Revenue Board at the following channels:

Ministry of Finance

Phone: (9am to 5pm, Sunday to Friday)

03-8882 9089

03-8882 9087

03-8882 9191

03-8882 4565

03-8882 4566

Telegram:

https://t.me/MOFPRE2020

E-mail:

bsh@treasury.gov.my

pre2020@treasury.gov.my

LHDNM (Inland Revenue Board)

Phone: (9am to 5pm, Sunday to Friday)

1-800 882 747

03-8911 1000

[/fusion_text][fusion_text]Founded in 1999, G&A Group is a well-established integrated professional firm, dedicated to provide an effective solution for business planning, accounts, tax, finance, IT and performance management. We have a group of professional and enthusiastic team that embrace a vision to provide quality and reliable services. We look forward to, build a lasting relationship with you.

Please drop us a message at info@ga.com.my or visit our website at www.ga.com.my for more information or further enquiries.

If you need further assistance, please feel free to contact our G&A Group HQ or branch contact personnel:

Our Hotline Service :

1700818791

Fynn – 010 931 8035

email : fynn@ga.com.my

Anne – 016 841 0821

email : anne@ga.com.my

[/fusion_text][fusion_text]Disclaimer clause:The information provided by G & A Group (“we,” “our”or “us”) on www.ga.com.my (the “Site”) [and our mobile application] is for general informational purposes only. All information on the Site [and our mobile application] is provided in good faith, however we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information on the Site [or our mobile application].[/fusion_text][/fullwidth]